HealthSouth Scandal: Crossing the Line

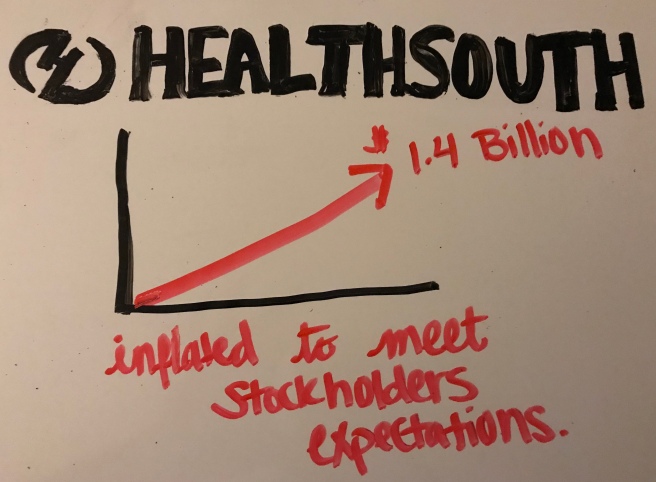

Fresh off of reading Critical Analysis of The New Perspective on Organizational Wrongdoing by Donald Palmer for an ethics class could not have been timed more perfectly. The article discusses an idea contrary to what most people think of when they think of ethics in business. The typical person sees an article about a businessman committing a white-collar crime and thinks that the person on the front page of that article was overwhelmed by greed. Palmer states the opinion that businesses in this current day actually facilitate this kind of behavior. It is not corrupt businessmen sneaking into companies but good men and women doing what they think of as correct but later finding out that their minds were warped by their environment. This, unfortunately, applies to HealthSouth Corp. This company, established by Richard Scrushy, focused on rehabilitation and eventually purchased the first acute care hospital becoming a public company on the New York Stock Exchange. The many people who worked behind the scenes of Health South Corp found themselves facing two options: focus on the profitability of the company they worked for or divert their attention to revenue, and inflate the numbers executives rely deeply on for their compensation and the continuation of their employment. As time went on “Investors and lenders became less concerned with profitability and seemingly more focused on revenue. If revenue was growing, investors seemed satisfied to provide the capital needed to fuel that growth” (Arxis). With demands like this form investors, it can become easy to succumb to the needs of the investor to make sure the company stays well supported and unfortunately, these workers chose the latter option. They ended up overstating the earnings of the rehabilitation and acute care hospital business by “anywhere from $3.8 billion to $4.6 billion” (FreePublic) in the course of several years (starting back in 1996). Of course, by exaggerating the numbers by this large volume, investors increased their original amounts in the company and then once the fraud was exposed, these investors lost out because the stock collapsed like it has in previous blog posts. This ruins the lives of shareholders for years to come.

According to HealthSouth: A Case Study in Corporate Fraud, the fraud occurred when “top company officials reviewed quarterly unpublished financial results and compared the results to market expectations.” When the results didn’t meet or exceed the expectations, managers then were expected to “fix it” by forging the numbers. Since at the time it was standard for auditors to automatically look at any transaction over $5,000, the managers would have employees smaller amounts of money (between $500 and $4,999) at a time.

This ethical dilemma is one many students could find themselves in. If you join a company and are trying to make your employer pleased with your performance, you may follow his lead or blindly do as he says. This is the crossing the line that Donald Palmer discusses in his article. You may legitimately feel as though you are doing the right thing and wholeheartedly believe that, but your environment may be skewering your values. Occasionally you need to reevaluate your values and reassess them to make sure that if you were to be caught, how would you feel? As discussed in my ethics class, if your actions you are currently at any point in time were printed on the front page of a newspaper, would you be proud of what was discussed in the article?

A reoccurring situation seems to be the employees trying to meet quantitative expectations on one occasion, but that creates issues during the next period’s statement and that repeats itself in a snowball effect. Management gets you to do it one time and then holds it over your head. Executives get the idea in their head that they are king and do not feel the need to address the well being of their subordinates. According to Weston Smith (a CFO), Scrushy at one point looked at him and said, “Leading a Fortune 500 company is kind of like leading the Mafia. You don’t just walk away.” Hannibal Crumple thought he could make a clean exit after doing most of the dirty work for HealthSouth by working in a different part of the company. Unfortunately for him, they would later come and threaten him, using his new positions powers to misstate debt so HealthSouth could look better on their financial statements.

One employee actually tried to combat the task of inputting fraudulent information. At least he did until his boss signed off on the entries. Then he felt that he was relieved of his responsibility up until he left the company and informed the audit team of the malpractice. Unfortunately, the story does not end there, management was able to convince them that they didn’t need to look into it because the ex-employee, Michael Vines, was a “disgruntled employee”. No further investigation was done.

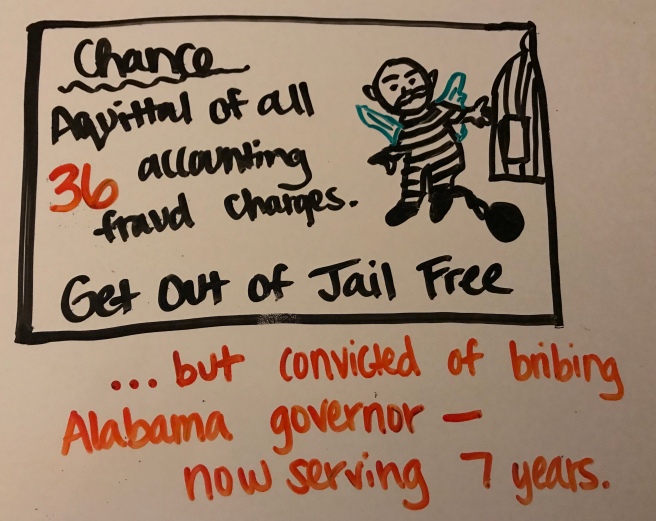

In the end, most employees turned against Scrushy to save their own future. Richard Scrushy, a seemingly successful but otherwise corrupt businessman was sentenced to 82 months (just under 7 years) in a federal prison, “three years probation, $267,000 in restitution, a fine of $150,000 and ordered to perform 500 hours of community service.” (Forbes)

While not the ideal story, it doesn’t have a completely tragic ending. The company is still around and has even been relisted on the NYSE stock exchange after paying about $425 million to both the SEC and the U.S. Department of Justice (Bizjournal). The former CFOs – Aaron Beam and Weston Smith – now speak at Leadership Development seminars about their experiences, it doesn’t entirely make up for their wrongdoings but it does help make some good come of the scandal.

Ethical Aspect of the Blog:

Ethics and Professional Judgment — This is the combination of determining what is best to serve the clients of a business with practices that are honorable and true. It is important to not only practice ethics in your professional setting but to also encourage your fellow coworkers to do the same. As a professional, it is your responsibility to do what is best to grow the business — but it is also your responsibility to follow the law and be honest with everyone.

As seen in several of the cases described before, many of the CEOs and CFOs did not practice both ethics and professional judgment. There were, however, some workers who did practice both ethics and professional judgment — the ones who brought the attention to the malpractices. They knew that it was in the best interest of the company to be truthful to the public and their investors rather than continue to lie and con people out of more money.